Three takeaways for businesses from the International Conference on Financing for Development (FfD4)

Read more

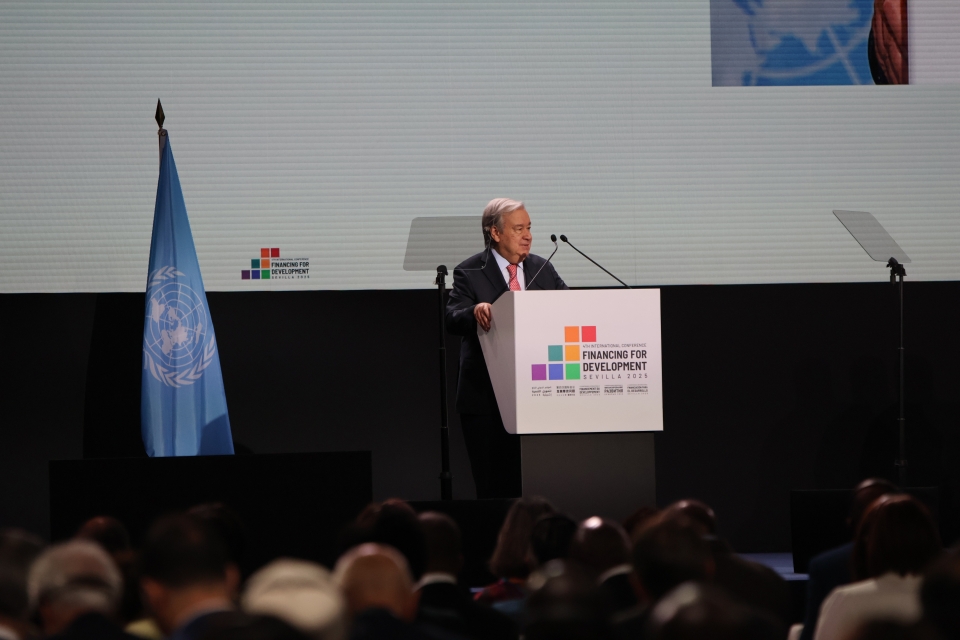

As the global financial sector wrapped up the International Conference on Financing for Development (FfD4) in Seville, Spain, last week, the stakes and the opportunities have never been higher. From mounting global crises to an ever-widening SDG financing gap, this pivotal event represented a call to action for the private sector, especially finance leaders, to align capital with purpose and unlock sustainable prosperity.

The Fourth International Conference on Financing for Development (FfD4) is a critical chance to mobilize the investments needed to achieve the Sustainable Development Goals (SDGs) before it’s too late.

Three takeaways from the International Conference on Financing for Development

Purpose drives profit

We need bold, collective action to mobilize private capital at scale, especially for developing countries. By aligning corporate finance with the SDGs and adopting credible KPIs, businesses can be a powerful force in closing the $2.5 trillion annual financing gap and delivering measurable impact.The private sector is not on the sidelines — it’s shaping financial markets

Through initiatives like the CFO Coalition for the SDGs and Forward Faster, companies are issuing billions in sustainable finance and embedding ESG (Environmental, Social, and Governance) into core operations. We must now scale blended finance and outcome-based instruments to de-risk investment and accelerate systemic change.Reform must be inclusive and transparent

To build resilient economies, we need reimagined global financial systems that work for low- and middle-income countries. That includes fairer debt resolution, more equitable SDR allocation and public–private collaboration that centres on accountability, innovation and shared prosperity.

A pivotal moment to build global cooperation

The world faces a convergence of crises, and the stakes are high. Rising debt burdens, declining aid budgets, growing trade barriers and an uncertain economic outlook are growing concerns. Even before these recent challenges, progress toward the SDGs was off track.

Today, the SDG financing gap has grown to an estimated $4 trillion annually. At the same time, from humanitarian crises to escalating climate disasters, the cost of inaction continues to rise. FfD4 offers the rare and urgent opportunity to mobilize for action.

As market demand for sustainable investment has increased notably in the last two decades, the unique role of the United Nations in convening and catalyzing finance has only become clearer. Since the Monterrey Consensus of 2002, the UN has provided a platform for more inclusive and transparent global financial discussions, shifting the focus from aid alone to a broader, integrated framework that includes public and private investment, trade and technology.

The business case for FfD4: finance as a force for transformation

With a $2.5 trillion SDG financing gap, companies, investors, financial institutions and relevant stakeholders must find a way to realign around the following priorities:

- Policy direction that shapes sustainable markets

- Strategic partnerships with multilateral banks, governments and civil society

- New instruments and incentives, including blended finance mechanisms that unlock new markets and de-risk investments

- Signal leadership by aligning corporate finance with SDGs, climate priorities and just transition pathways

Businesses that move Forward Faster on sustainability are already tapping into green tech, inclusive finance, clean energy and healthy business models.

FfD4 also recently hosted the International Business Forum, designed to unlock private sector solutions and finance. In parallel, hundreds of events gathered stakeholders from every sector, from grassroots organizations to multinational institutions. At FfD4, many collaborated to co-create solutions around food security, access to clean water, climate resilience and public health. One fact remains abundantly clear: how we finance development determines whether we can build a fair, safe and sustainable future.

“Those that rise to this moment will not only rescue global development but also secure a decisive edge in the sustainable economy of tomorrow” writes CEO and Executive Director of the UN Global Compact Sanda Ojiambo in Reuters.

At stake is not just how we finance development, but how we rebuild trust, restore equity and reignite global cooperation. The path to 2030 runs through FfD4, and success will depend on leaders acting decisively, the willingness of stakeholders to collaborate and the recognition that sustainable development is worth financing. Now is the time to deliver together.